Who are the Ghost Employees?

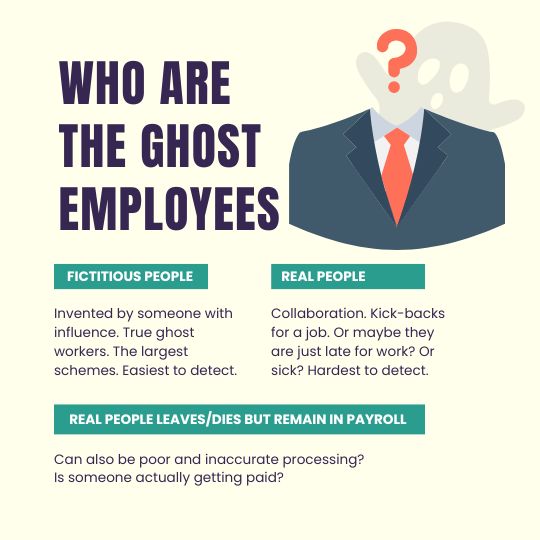

Ghost employees are individuals who are listed in the payroll but do not actually do any work. People in this category can either be real persons who are unaware of their situation or fictitious people created by fraudulent personnel.

Ghost employees can be further divided into three categories:

- fictitious people

- real people

- real people who have already passed away or have left the company yet still get paid

How Can Ghost Employees Affect your Company?

Ghost employees are those that are paid but do not actually exist, creating uncontrolled labor costs with long-term negative effects. Profits gradually erode when this fraud goes unnoticed, and project estimates in the future become less competitive or yield fewer profits because of it. Ultimately, companies can become victims of ghost employee fraud when internal systems aren’t able to detect it quickly.

How to Prevent Ghost Employees in your Company?

Ghost employees can be a major business threat, but their presence isn’t inevitable. To prevent them, regularly conduct payroll audits in which you compare employee listings with those of the company. Your HR managers should also be current on who is entering and leaving the workforce, so that payroll and other records can quickly reflect any changes. With these steps in place, your company will be better-protected from ghost employees.

Utilize Automated Solutions.

Automated payroll systems provide a much safer option for businesses than manual payroll management when it comes to avoiding ghost employees. Ghost employee fraud occurs when someone creates a fake employee and pays them with the company’s money. This kind of fraud is much harder to perform as automated payroll systems are less prone to errors or confusion in executing payments. If switching to an automated payroll system is not yet feasible, businesses should still take steps to reduce their risk of being targeted by ghost employee fraud such as separating and rotating payroll duties, ensuring that all movements and areas in the process remain under close scrutiny, and of course maintaining a reliable system.

Increase Scrutiny and Supervision of Payroll Documentation

Increasing your scrutiny and supervision of payroll documentation is one of the most effective ways to identify ghost employees. Make sure that you are keeping thorough records, with complete information on all salary payments. Conduct regular follow-ups with personnel to ensure accurate payment data, and compare this information against payroll records. Additionally, if you notice discrepancies or inconsistencies in payment data, then further investigation should be carried out.

All records of deceased or resigned employees must be quickly removed from payroll databases and intranet directories. It is also important to clearly define when and how the connections between these people and the business were severed.

Implement Policies and Procedures.

To prevent ghost employees from slipping into your payroll process, you should create and properly define a clear set of steps for getting new hires added to the list. This process should include who has the responsibility to add people to the payroll, make salary adjustments, and submit documents to the bank. Furthermore, determine individual or team goals in your payroll and finance team to ensure that everyone follows existing procedures. With this information at hand, ghost employees can be avoided in your organization.

Perform Regular Audits.

Regularly performing comprehensive audits of employee pay, tax forms, and other business records is one of the most effective strategies for identifying ghost employees. During the audit process, it’s important to review hours worked versus hours paid to ensure that there are no discrepancies between payments and actual time worked. Auditing can also help detect any suspicious payments or activities with regards to employee payroll.

Use Biometrics Attendance

A biometrics attendance tool helps to minimize the risk of ghost employees by eliminating the need for employees to type in complex passwords to manually log their time. This system is more user-friendly, since it requires only secure access with biometric information. However, it is important to take measures to protect one’s biometric data and secure access as this still does not make it completely fraud-proof. Biometrics can help prevent fraudulent activity that may be organized out of desperation or a rush, but cannot always guarantee complete prevention.

Conduct a Performance Review

To prevent ghost employees from being added to payroll, pay close attention to details. Have personal performance reviews for all roles in the organization. Look out for position that don’t often need review or evaluation and be sure to include those in the process. By doing so, fraudsters will find it difficult if not impossible to hide behind an inactive employee’s identity.

Stay up-to-date with Data Security.

Companies must take proactive measures to guard against the risk of ghost-employee scams. With advances in technology, criminals are coming up with more sophisticated ways to perpetrate these frauds. Companies must be sure to stay alert and invest in the latest systems and protocols to protect their organization’s data. Failing to do so could result in significant financial losses. For that reason, updating your cybersecurity measures is essential for all businesses.