December is indeed a month of an Epicurean feast for Filipinos. From buying gifts, attending parties, to hitting the 5,000 calorie mark on Noche Buena, we sure do love to indulge in the holiday season. But above all that, nothing makes us more excited — especially employees — than our 13th month pay. And while you’re here, I think it’s important that you know how to compute 13th month pay in 2024 — may you be from the HR department or not.

Keep in mind that it is basically an extra month monetary compensation for working on the entire year. However, the computation will vary depending on your salary and length of service for the whole calendar.

What is 13th month pay?

13th month pay is a mandatory benefit given to every employee in accordance with Presidential Decree No. 851. The said decree mandates employers to grant 13th month pay to each of its rank-and-file employees. To keep it short, 13th month pay is equal to 1 ½ of the employee’s annual salary.

Who are rank-and-file employees?

Rank-and-file employees are those who are not considered managerial employees. Managerial employees, on the other hand, are those whose contract employment requires them to hire, promote, transfer, dismiss, reward, and discipline other employees.

What is included and not included in the 13th month pay computation?

For the most part, the 13th month pay covers only the basic salary of an employee. This includes your basic pay and your paid leaves, including sick leave, maternity leave, and vacation leaves.

However, it does not include the following:

- Bonuses

- Incentives

- Commissions

- Allowances

- Overtime pay

- Holiday pay

- Unpaid leaves

- Night differential

- Unused vacation and sick leave

How to compute 13th month pay?

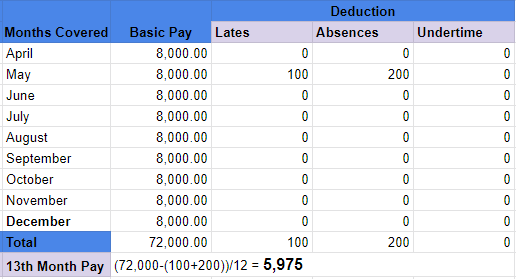

Generally, 13th month pay is computed based on 1/12 of your total basic salary for the whole calendar year. But to put it simpler, the formula is to get your annual basic salary (basic salary times months rendered), deduct your unpaid absences, then divide it into 12.

13th month pay = (Annual Salary – Unpaid Absences)/ 12

Here’s an example:

This is the simplest way on how to compute your 13th-month pay. Easy as 123!

More questions about 13th month pay

1. When will you get your 13th pay?

According to the law, it should be granted not later than December 24 every year. In most cases, employees receive their pay as early as first week of December, while some receive it within the Christmas week. However, some employers may give ½ of the employees’ 13th month pay before the opening of the regular school year and the other half on or before December 24.

2. What happens if the employer fails to provide 13th month pay?

Employers think they can get away with not providing their employees their 13th month benefit — but they can’t. Employers who fail to do so can be subjected to administrative cases. For employees, it is highly encouraged to report such a case at the nearest DOLE office.

3. Will resigned or terminated employees receive their 13th month pay?

Short answer, yes.

4. How much will a resigned or terminated employee receive?

The 13th month pay of a resigned or terminated employee is equivalent to the length of time he or she spent working during the year. The length of time is proportional a.) to the time he or she started working during the calendar or b.) the last time the 13th month pay was received, up until his or her resignation/termination.

For your information: 14th month pay

Senate President Vicente Sotto III has re-filed Senate Bill No. 10 or the act that provides 14th month pay to government and private sector employees regardless of the employees’ status of employment. But unlike 13th month pay, 14th month pay shall be paid on or before May 31st of each year to prepare for the school enrolment.

However, the 14th month pay is still a strained dream for all employees who are seeking additional income. Since the bill’s filing last July 2016, it is yet to be an enacted law. Department of Labor Secretary Silvestre Bello III stated that DOLE is still consulting with labor and management regarding the feasibility of the 14th month pay to the employees.

Comments are closed.