We all know that the employees are a company’s greatest asset, no matter how big or small the company is. The company should make efforts to cost-effectively meet their employee’s needs resulting in inspired and productive employees. As an employer, it is your job to do that by giving them the proper employee benefits as mandated by the government.

Here are the important employee benefits in the Philippines that you need to know so that you can ensure satisfaction for your employees.

Types of Employee Benefits in the Philippines

To keep it basic, there are three types of employee benefits in the Philippines– wage and compensation benefits, leave benefits, and mandatory government contributions. We will elaborate on each one below.

Wage and Compensation Benefits

1. Minimum Wage

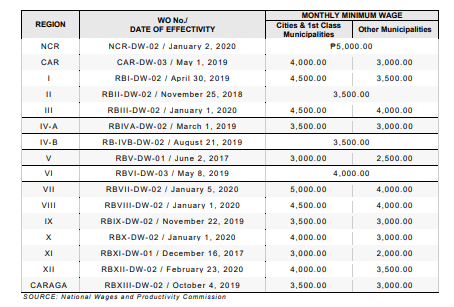

According to Republic Act No. 6727 (also known as the “Wage Rationalization Act”), there are fixed minimum wages applicable to different industrial sectors. It also varies from region to region. Here is the summary of current regional daily minimum wage rates as of February 2020:

Make sure to learn how to compute your employee’s payroll the easiest way!

2. Separation pay

The employer must give this to employees who are terminated from the company. However, terminated employees who are involved in misconduct and crime will not be given any separation pay.

3. Nigh Shift Pay

Night shift pay or night shift differential applies to those employees who work between 10:00 PM and 6:00 AM. Take note: employers must give an additional 10% premium to the employee for every hour at work.

4. 13th Month Pay

The company must grant a 13th-month pay equivalent to one month pay to all eligible employees. They must make sure to work at least one month during a calendar year.

5. Separation pay

Separation pay is for the employees who are terminated from the company. However, terminated employees who are involved in misconduct and crime will not be given any separation pay.

6. Retirement pay

If an employee decides to retire at the age of 60 or more, the employer must grant him a retirement pay equivalent to at least half of his month’s salary for every year of service. To apply for this benefit, he must work under the company for at least 5 years.

Leave employee benefits

1. Service Incentive Leave

According to Article 95 of the Labor Code, an employee who has worked for a year is granted five service incentive leave with full pay.

2. Parental leave

There are three types of parental leaves, including maternal, paternal, and solo parent leave.

Maternal leave is for any pregnant employee who worked with the company for at least six months. The employer must grant this at least two weeks before her due date and four weeks after normal delivery or miscarriage.

All married male employees have the right to paternal leave. They are eligible for 7 working days up to four childbirth. Additionally, this employee benefit is only available within sixty days from the day of delivery or miscarriage.

Lastly, single mothers and fathers can use their solo parent leave. The good thing about this leave is they are provided with seven days of leave with pay for every year of service.

3. Leave benefits for women employees

There are two types of special leave benefits for women. The first one, Magna Carta is a type of special leave for female employees who underwent surgery caused by gynecological disorders. Another special benefit is also provided to the victims of violence against women and their children. Employers must provide them with ten days of leave which covers the days where they have to attend to medical and legal concerns.

4. Bereavement Leave

Although this is not a paid leave, it is given to employees to mourn for the death of their immediate family members

5. De Minimis Benefits

These may be optional for employers to grant. De minimis benefits include calamity leave, rice subsidy, and daily meal allowance.

Required Government Contributions

These are the government contributions that will be automatically deducted from regular employees. There are three main types of government contributions, including:

1. SSS

The SSS or Social Security System is a type of insurance program for all wage earners from the private institutions in the Philippines. The contribution varies depending on the employee’s salary. Mostly, the SSS contribution is a shared payment between the employee and its employer.

2. PhilHealth

PhilHealth is a health insurance program for private employees that provides health care privileges and financial aid to its employees. Just like SSS insurance, both the employer and employee share payment for PhilHealth.

3. Pag-IBIG

Pag-IBIG is a national savings program that aids financing office for affordable homes. Again, both the employee and his employer share payment for this benefit. The good thing about Pag-IBIG is it gives you benefits, including housing loans, multi-purpose loans, calamity loans, and secured savings.

As an employer, it is important to be aware of the employee benefits in the Philippines. If you have any concerns, feel free to contact the Department of Labor and Employment through the following contact details:

DOLE Hotline: 1349

Comments are closed.